am a studio product photographer shooting remotely. I shoot mostly outdoor clothing along with bags, shoes, hats, belts, and other accessories. Clients send me the product via FedEx ground, and I photograph it in my home. I have two rooms dedicated to studio / office space. I shoot most items on white and then do all the postproduction myself. I deliver the images to my client via Dropbox and then send the product back. In the past I have had a variety of clients but for the last 5 years I have only been working primarily with one client, a national clothing company.

I used to also shoot outdoor lifestyle images but since having kids 12 years ago my focus has been studio images.

I coordinate with the local high school and hire students with learning challenges to work a couple hours a week during the school year. The school pays the kids minimum wage which is currently $15 an hour in California.

I write off a portion of my home expanses for the studio space I have in my house. My house is paid off, but I have done a lot of renovations in the last 3 years. I also have accumulated a lot of studio and camera equipment over the years and try to upgrade when I have had a profitable year. I also use cleaning companies, and contract photo assistants / photoshop tech when I am busy with tight deadlines. My cleaning service is $350 a month for a few hours of work 2 days a month. I pay my photoshop tech who is currently a college student and works remotely $24 an hour.

I would like to add that Health Insurance has always been a big expense for our family. I don’t think I could still be in business today if it wasn’t for the implantations of the Affordable Care Act. Expanding the income levels has also been helpful. When my husband was still alive, and we were both self-employed, we weren’t always able to qualify for subsidies depending on how profitable were in a given year.

Now that it is just me and two kids, I have been able to qualify each year. This is a gigantic savings for me. I currently have a Silver Blue Shield policy for the 3 of us that would be over $1800 a month on the open market. Through Covered California is it costing me around $450 a month instead.

I always maximize both my Traditional IRA and SEP IRA accounts yearly. In 2022 I contributed $7,000 into my Traditional IRA and over 16,000 into my SEP IRA. These contributions also lower my “Adjusted Gross Income” which usually allows me to qualify my family of 3 for some health care subsidies through the Affordable Care Act.

In 2022 I worked about 180 full days on client work. Other days are spent paying bills, bookkeeping, ordering supplies, upgrading my studio space, and end of the year tax stuff.

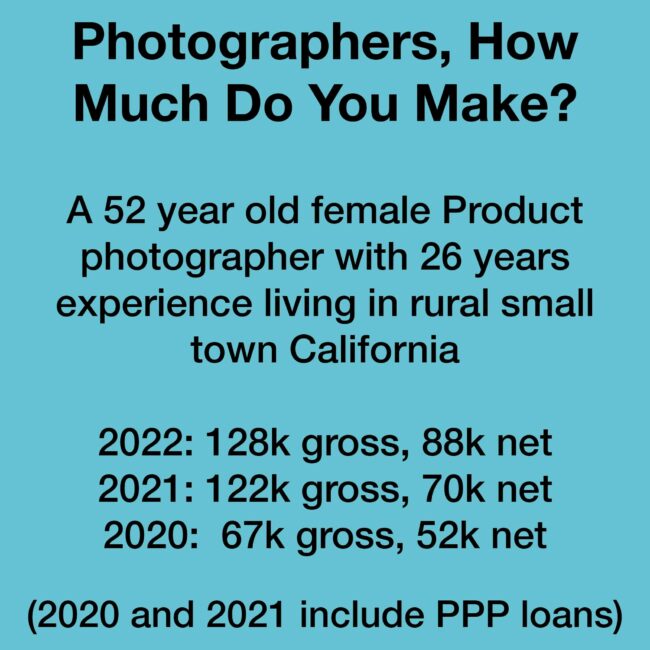

My income has always fluctuated depending on how many clients I have at the time and the size of the companies I am working with. Some of my biggest earning years were 2009, and 2017. My wages have not kept up with inflation and I was actually making more per day in those bigger years. In the past, the fluctuation didn’t matter as much because my husband had a full-time job as well. However, he died in 2020 at the start of the pandemic so now the income fluctuation is a concern. My current client is trying to do more images in-house so I expect my income to drop this year unless I can find additional clients. During years that my business slow, I would spend my time doing home improvements to better the equity in our home. My husband did the same. We both had home offices so this also improved our workspace. We were lucky that our business yo-yoed at different times and the home projects helped our long-term financial goals. The only time we both plummeted in profits was 2010 and 2011 which was also when we finally had kids. Things were tight for a while, but it also allowed me more time with my kids when they needed me the most.

My two kids get survivor benefits from their deceased dad until they are each 18. The money goes to me to cover their monthly expenses. I also put a portion of it into their college savings account. Each kid gets about $1700 a month for a total of $3200 a month. This has been additional income since my husband died in 2020 and it is a great buffer in slow months. However, it is less than 1/3 of what his income was when he was alive. Having a partner for over 20 years that also had a full-time job was instrumental in my success as a photographer.

I try and work 7 hours a day 4 days a week when I know product is coming my way. If I am asked to meet a tight catalog deadline, I might work 10 hours a day and on the weekend. In the past I would also charge a “rush fee” for overtime hours but I haven’t done that lately.

I charge per item and the rate depends on the type of item or accessory. Therefore, my rates are consistent and more dependent on how productive I am on a given day.

I have done very little in the last 12 years to market myself. This is something I need to work on if I want to stay in business. It is not a good idea to be reliant on only one client.

I was told that I could never make money as a photographer and that photography should only be a hobby. Best or worst advice?

This is a tough business. It is easier to be lean, aggressive, and mobile when you are young and single. However, now that I am a single mom with two kids, I am not sure it is the best career choice. I am trying to find ways to diversity my work so I can find a more secure place for my family. Save when you can and put money away for the slow times. Also, when you have extra cash, invest in things that will help you and your business in the future.